Latest

testing

The Rise of Smart Coffee Machines

Token of Trust (TOT): Building Digital Trust in a Secure World

No-Code Shopify Plugin for Age-Restricted Stores

State Compliance Guide: Vape & Nicotine 2025

As state-level regulations evolve across the U.S., manufacturers, distributors, and retailers of vapor and alternative nicotine products are entering a more complex compliance environment. With excise tax hikes, product certification mandates, and stricter sourcing rules rolling out in the second half of 2025, staying ahead of these changes isn’

Does the PACT Act Apply to Your Vape Business?

The Hidden Risk in Vape Shipping Many vape businesses believe the PACT Act only applies to retailers shipping directly to consumers. But that assumption could put your operation at risk. If you ship ENDS (Electronic Nicotine Delivery Systems) products across state lines, even to other businesses, you may have reporting

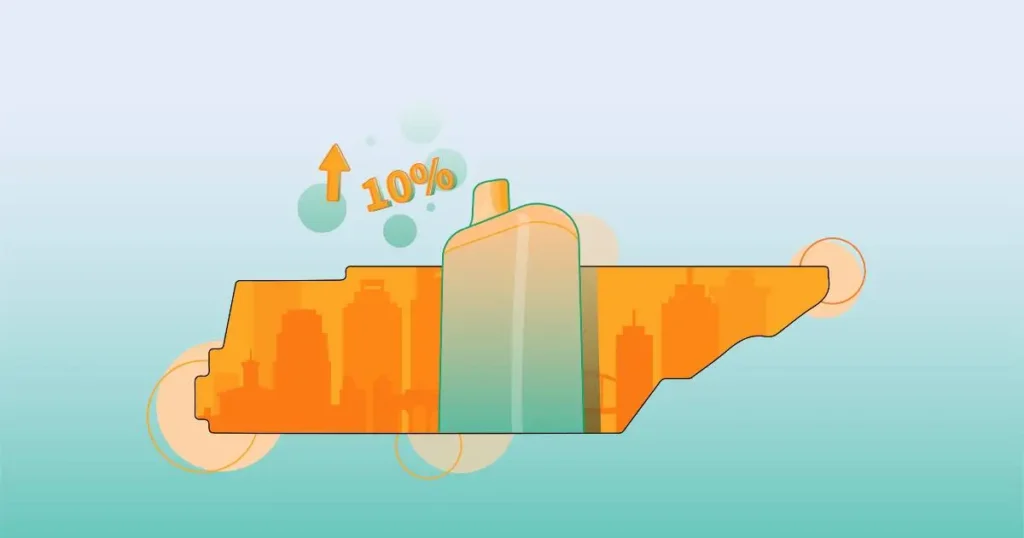

Tennessee Excise Tax Rate Goes Live in July

On July 1, 2025, Tennessee will begin enforcing a 10% excise tax on the wholesale cost of vapor products — marking one of the most aggressive regulatory shifts for alternative nicotine in recent years. While this law applies specifically to Tennessee, it signals something much larger: excise tax expansion is accelerating

Vape Tax Rules Retailers and Wholesalers Get Wrong

Vape tax rules aren’t one-size-fits-all. Vape tax rules vary by product, location, and buyer. Knowing your role — retailer or wholesaler — isn’t enough. You also need to look at each sale. What price does the tax apply to? Who needs to pay it? If you don’t have proof

Simplify Exemption Certificate Management Today

Selling vape, hemp, and alternative products comes with strict compliance demands, and staying ahead isn’t optional. Yet, many wholesalers still manage exemption certificates manually, relying on spreadsheets, scattered emails, and outdated methods. This manual approach doesn’t just slow you down. It creates real compliance risks that can cost

China Vape Tariffs in 2025: How Businesses Will Adjust

New vape tariffs in 2025 will create challenges. However, vape businesses can turn these changes into opportunities with the right strategies and partnerships. With better planning, vape businesses can improve. Stronger supply chain connections will help them adapt. Good compliance support is also important. This way, both B2C and B2B

What if I receive a Vape PACT Act Cease and Desist Letter?

In recent times, the vape industry has seen a surge in cease and desist letters, particularly concerning the sale of flavored electronic nicotine delivery system (ENDS) products. Notably, R.J. Reynolds Vapor Company ([TCVD]) and its legal representatives have been active during 2023 and 2024 in this realm. These letters

Tax Compliance

Navigating 2024 Vape Excise Tax Changes: What Do Hawaii and Nebraska Mean for Your Business?

Why Should Vape Merchants Worry About Hawaii and Nebraska Excise Tax Changes? As we gear up for 2024, vape industry e-commerce merchants face significant excise tax adjustments in Hawaii and Nebraska. Wondering how this impacts your business? Let’s break it down. What’s Up with Hawaii’s Act 62?

Excise Taxes

Token of Trust’s “Product Sync” Feature: Simplify Your E-commerce Business

In the fast-paced world of e-commerce, staying on top of tax regulations can be a challenging task for online retailers. Token of Trust understands the complexities involved in managing excise taxes for various products and is constantly striving to make the process easier and more efficient for merchants. We are

Tax Compliance

Empowering Alternative Products Startups: Token of Trust’s Startup Program for Excise Tax Reporting and Compliance Support

In the dynamic world of commerce, alternative product startups are emerging as key players, catering to consumers seeking vape, e-cigarette, nicotine, CBD, delta-8, delta-9, and hemp-derived products. As these startups and small businesses navigate the path to success, they face a unique set of challenges, including excise tax reporting and

Tax Compliance

Token of Trust: Dominating G2’s Summer 2023 Reports with 11 Awards

Token of Trust, the trailblazing leader in digital trust and verification solutions, has achieved exceptional success in G2’s highly regarded Summer 2023 Reports. With an impressive collection of 11 awards across three vital categories — Identity Verification, Age Verification, and Sales Tax & VAT Compliance — Token of Trust stands out

Vape Products

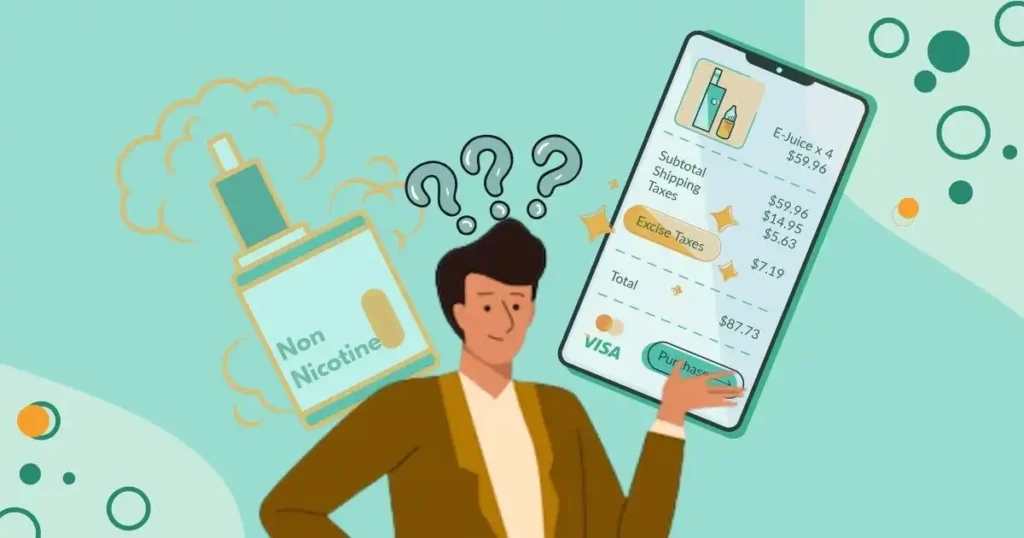

Are Non-Nicotine Vaporizers Affected by the PACT Act?

By now, manufacturers, distributors, wholesalers, and retailers of vaporizer products containing nicotine are aware of the PACT Act and its implications on their business. But many companies focusing on non-nicotine vaporizer products have varying awareness and opinions on if and how it applies to them. This article intends to answer

Excise Taxes

How Do Vape Companies Manage Excise Taxes in 2024

Managing excise taxes has become a significant challenge for many companies, particularly in the vaping industry. These taxes can substantially impact pricing and profits, making it essential for businesses to navigate them effectively. Learning how vape companies are successfully adapting to these changes provides valuable insights for all businesses facing

Vape Products

More States = More Sales

The step by step plan to grow your e-commerce vape business sustainably and profitably. The most common questions we receive on a daily basis: “Who should I use to ship my products?” “Who can guide me to get registered and licensed into a state?” Once I’m registered, how can

Vape Products

How California’s Electronic Cigarette Excise Tax Impacts Your Business

California’s Electronic Cigarette Excise Tax (CECET) has dramatically reshaped how vape products are sold across the state. It impacts pricing, influences consumer behavior, and affects the broader vaping industry, marking a pivotal moment for both retailers and users. Since its implementation, businesses must collect a 12.5% excise tax